Date Published: 2025/07/16

Read Time: mins

How aftermarket auto parts and performance mods affect your collector car insurance

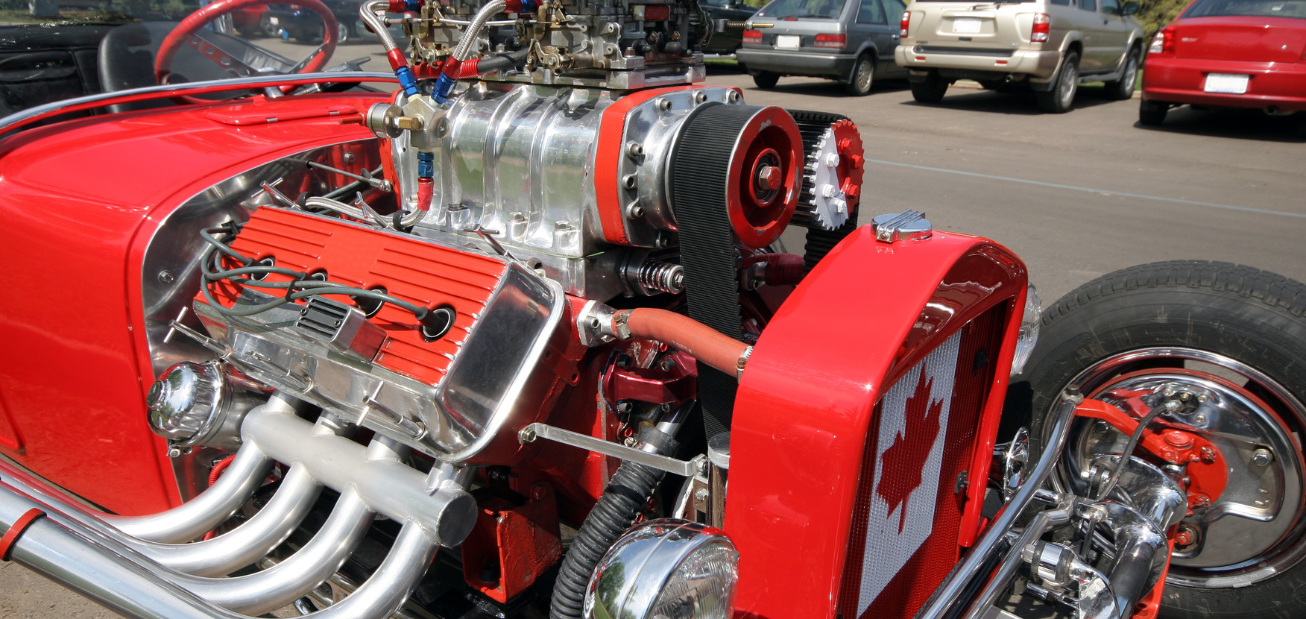

For many Canadian car enthusiasts, customizing a classic or collector vehicle is a labour of love. Whether it’s a vintage Mustang with a modern turbocharged engine or a cherry-red '67 Camaro with a fresh coat of custom paint, every upgrade adds personality, performance and uniqueness to your ride. While these upgrades offer benefits, they can also create unexpected vulnerabilities, especially when it comes to insurance coverage.

Let’s talk about what those risks might be and how you can avoid them.

Why car modifications affect your insurance

When you modify your vehicle, you're changing more than just its appearance. You’re also altering its value, risk profile, and repair costs. These are all critical factors insurers use to determine your premium.

- Increased value: Custom parts like high-performance engines, premium sound systems, or rare imported accessories can significantly raise your car's market and replacement value. If your insurance policy doesn't reflect these upgrades, you may be at risk of not having the proper coverage in the event of a claim.

- Higher risk: Performance enhancements, like engine or exhaust system upgrades, can alter how your vehicle handles on the road. Adding more horsepower, sharper acceleration, or modified braking may increase your vehicle's risk of being involved in an accident compared to others.

- Theft appeal: Eye-catching upgrades like custom rims, paint jobs, high-end audio systems, or rare trim pieces can make your car a bigger target for theft. The more valuable and attention-grabbing your vehicle becomes, the higher the risk of theft.

Important: Insurers will not cover any illegal vehicle modifications, even if you have them done by a professional. A custom part or modification that breaks provincial laws or Transport Canada regulations could void your coverage entirely.

Why you need to disclose modifications to your insurer

If you install aftermarket parts or performance upgrades without informing your insurer, you may be violating the terms of your insurance policy.

Failing to inform your insurance broker or agent about modifications or providing false information can result in your insurer denying a claim or even cancelling your policy entirely. If an accident occurs and your insurer finds out about hidden modifications, you could be left without coverage and liable for damages.

In addition to insurance disclosure, modifying key components of your vehicle may require a new vehicle permit. If you change your engine, fuel system, doors, axles, or the vehicle's body style, you will likely be required to apply for an updated permit. Review your local, provincial, and federal laws and regulations before making any modifications.

Steps to protect your modified collector car

Your collector car is more than just a vehicle. It’s a passion project. Here’s how to make sure it’s properly protected:

- Talk to your insurance broker first: Before you upgrade to high-performance car components or install aftermarket auto parts, ask how it will impact your policy. Your broker can help you understand which mods are insurable and which might raise red flags.

- Consider "agreed value" coverage: Some insurance companies offer an agreed value policy. This type of policy lets you and your insurer agree on the car's value upfront, accounting for customizations. If the vehicle is totalled or stolen, you'll be reimbursed for the agreed amount rather than the depreciated market value.

- Keep all documentation: Save receipts for every modification, take dated photos, and track the installation process. This documentation is crucial in the event of a claim or when adjusting your policy to reflect upgrades.

- Stay legal: Ensure all your modifications comply with Transport Canada regulations and local provincial laws. If your modification doesn't pass inspection or violates safety standards, it could jeopardize your insurance.

Make sure you’re covered

High-performance cars and aftermarket auto parts can transform your collector vehicle into a showstopper, but they also change how insurers view your car. Don’t risk being underinsured.

Contact an Orbit collector car insurance broker today to ensure your modified vehicle is properly protected. We'll help you find collector car insurance that fits your needs so you can focus on enjoying the ride.